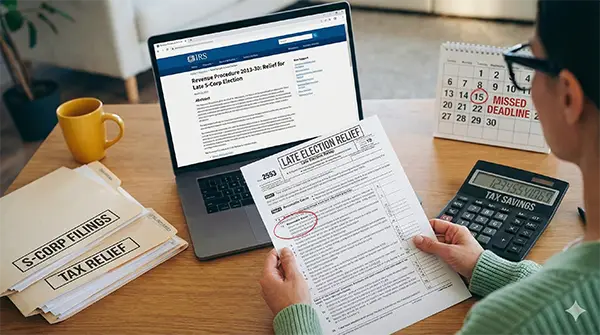

Missed the Deadline? This is How to File a Late S-corp Election! (Form 2553 Relief)

📋 Key Takeaways Late Election Relief: Missing the IRS Form 2553 deadline does not automatically disqualify a business from S-Corporation tax treatment if relief requirements are met. IRS Safety Net: Under Revenue Procedure 2013-30, the IRS allows late S-Corp elections within a 3-year and 75-day window for eligible businesses that acted in good faith. Reasonable […]

Missed the Deadline? This is How to File a Late S-corp Election! (Form 2553 Relief) Read More »