📋 Key Takeaways

-

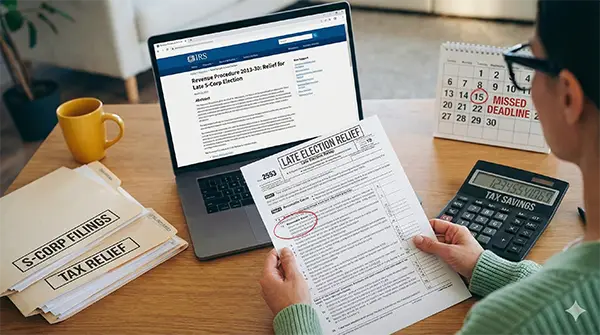

Late Election Relief: Missing the IRS Form 2553 deadline does not automatically disqualify a business from S-Corporation tax treatment if relief requirements are met.

-

IRS Safety Net: Under Revenue Procedure 2013-30, the IRS allows late S-Corp elections within a 3-year and 75-day window for eligible businesses that acted in good faith.

-

Reasonable Cause Requirement: Approval depends on a clearly documented reasonable cause statement showing intent to elect S-Corp status and consistent tax compliance.

-

Filing Accuracy Matters: Errors in Form 2553 or poorly drafted explanations can result in denial of retroactive S-Corp status and permanent loss of tax savings.

- Professional Oversight: Working with a tax professional significantly reduces risk and improves approval outcomes for late S-Corp election filings.

You just realized you missed the S-Corp deadline. Maybe your accountant mentioned it casually. Maybe you discovered it while Googling late at night. Either way, the panic is real.

Here’s the good news: a late S-Corp election is far more common than you think, and in many cases, it’s fixable. This article explains how late S-Corp election relief works, who qualifies, and how to file Form 2553 safely after the IRS Form 2553 deadline has passed. This is mainly for LLC owners and corporations with real profits who want to avoid overpaying taxes by tens of

thousands of dollars. We’ll show you the safest path forward without guessing, shortcuts, or unnecessary risk.

Understanding the IRS S-Corp Election Deadline (And Why It’s Missed)

The Standard 2.5-Month Rule

The IRS requires businesses to file Form 2553 within two months and 15 days of the start of the tax year for which S-Corp status is requested. For calendar year entities, that deadline is March 15. This rule catches people off guard because it feels arbitrary.

Many business owners assume they can elect S-Corp status when filing their tax return or after seeing profits increase.

By the time they learn otherwise, the deadline has already passed. March 15 matters because it determines whether your S-Corp election applies to the current tax year or gets pushed to thefollowing one.

The Three Critical Dates Most Owners Confuse

There are actually three important dates that come up repeatedly in late election situations:

- December 31: The last day of the year. Your business activity during the year sets the stage for whether a retroactive election may be possible.

- January 31: In certain situations, an S-Corp election filed by this date can still apply to the prior year, if specific IRS conditions are met.

- March 15: The standard annual deadline for timely S-Corp elections.

Missing one of these does not automatically mean you’ve lost S-Corp eligibility. It simply means

you may need to rely on IRS relief provisions instead of a standard filing.

The Real Cost of Missing an S-Corp Election

How High-Revenue Businesses Lose the Most

The financial impact of missing an S-Corp election goes far beyond a late form. Without S-Corp status, most profitable LLC owners pay self-employment tax on all net income.

With an S-Corp, income is split between a reasonable salary (subject to payroll taxes) and distributions (not subject to self-employment tax). For many businesses, that difference translates to $10,000–$40,000+ per year in avoidable taxes. This isn’t a paperwork issue. It’s a cash issue.

If you’re unsure why business owners pursue S-Corp status in the first place, we break down the tax savings in detail in our guide on LLC to S-Corp tax benefits.

Why Waiting Another Year Makes It Worse

Some owners decide to “just fix it next year.” That decision often doubles the damage.

Every year without S-Corp status compounds the loss. Worse, you may lose the ability to elect retroactively, even if you otherwise qualified.

Time matters more than most people realize.

See if You Qualify for Late S-Corp Election Relief

Some owners decide to “just fix it next year.” That decision often doubles the damage.

Every year without S-Corp status compounds the loss. Worse, you may lose the ability to elect retroactively, even if you otherwise qualified.

Time matters more than most people realize.

The IRS Safety Net — Late S-Corp Election Relief Explained

What Is Revenue Procedure 2013-30?

Recognizing that many taxpayers miss the deadlines despite acting in good faith, the IRS created Revenue Procedure 2013-30.This rule provides Form 2553 relief for businesses that intended to be taxed as S-Corps but failed to file on time. It exists to correct honest mistakes not to enable tax abuse. If your business qualifies, the IRS may allow your S-Corp election to be treated as timely, even though it was filed late.

The 3-Year and 75-Day Relief Window

Under Revenue Procedure 2013-30, businesses may request relief if:

- The intended S-Corp election date was within the last 3 years and 75 days, and

- The business has consistently acted as if it were an S-Corp

When approved, this relief grants retroactive S-Corp status, allowing you to claim tax savings for prior periods that would otherwise be lost. A common misconception is that relief applies automatically. It does not. You must file correctly and meet all requirements.

Reasonable Cause — The Make-or-Break Factor

What the IRS Looks For

The cornerstone of any late S-Corp election is the reasonable cause statement.

The IRS looks for three things:

- Clear intent to be taxed as an S-Corp

- Consistent tax and accounting behavior

- No attempt at abusive tax avoidance

Your explanation must show that the failure to file on time occurred despite reasonable diligence

not negligence or strategic delay.

Examples of Acceptable Reasonable Cause

Common situations that may qualify include:

- Miscommunication with a tax professional

- Reasonable reliance on incorrect professional advice

- Administrative oversight during business formation

- Lack of awareness despite acting in good faith

Each case stands on its own. The details matter.

What Can Get Your Request Denied

Late elections are often rejected due to:

- Generic or boilerplate explanations

- Inconsistent prior tax filings

- Missing shareholder consent

- Contradictory effective dates

Once denied, fixing the issue becomes significantly harder.

Step-by-Step — How to File Form 2553 Late (And Where People Mess Up)

Step 1 — Confirm Eligibility

Before filing, confirm that your business qualifies for S-Corp status. This includes entity type, number of shareholders, shareholder eligibility, and having only one class of stock.

Skipping this step creates unnecessary risk.

Step 2 — Prepare Form 2553 Correctly

Form 2553 must include:

- The correct effective date

- The late election relief notation

- Proper shareholder signatures

Small errors here can invalidate the entire filing.

Step 3 — Draft the Reasonable Cause Statement

This is where most DIY filings fail.

Wording matters. The IRS reviews intent, timing, and consistency. Templates often miss context or include language that weakens the request.

Step 4 — Submission and Follow-Up

Form 2553 is submitted to the appropriate IRS service center. After filing, your Form 2553

status must be tracked. Response times vary, and silence does not always mean approval.

Let Our Experts Handle Your Form 2553 Filing Safely

Because late S-Corp elections are difficult to correct once denied, many business owners choose professional oversight to reduce risk.

Why DIY Late S-Corp Elections Are Risky

The Hidden Risks Most Business Owners Don’t See

On paper, filing Form 2553 late looks simple. In practice, it’s one of the most commonly mishandled IRS elections. The biggest risk is silent denial. The IRS does not always send a clear rejection notice. Many business owners assume approval, operate as an S-Corp, and only discover years later during an audit or notice that the election was never accepted.

Another major risk is the loss of retroactive S-Corp status. If the filing is incorrect or the reasonable cause statement is weak, the IRS may deny relief entirely. At that point, you can’t simply refile.

The opportunity is often gone. Audit exposure also increases. Retroactive payroll adjustments, reclassified distributions, and amended returns draw attention, especially when the original election paperwork doesn’t align with prior filings. These risks aren’t theoretical. They happen regularly, especially when templates or generic advice are used.

When Professional Help Is the Smart Move

Professional assistance becomes especially important when:

- Your business earns significant profit

- More than one tax year is involved

- Payroll or distributions were already taken

- Prior returns assumed S-Corp treatment

- Ownership or structure is even slightly complex

In these cases, the cost of getting it wrong far exceeds the cost of doing it properly the first time.

Already Considering an S-Corp? Start With the Strategy

Late election relief solves a timing problem. It does not answer a more fundamental question:

Does S-Corp status actually make sense for your business? Before filing or even while pursuing

relief it’s important to understand the mechanics and trade-offs of S-Corporation taxation.

Factors like reasonable salary requirements, payroll compliance, and long-term growth plans all matter. If you haven’t already reviewed the underlying tax strategy, start with our in-depth guide on LLC to S-Corp tax benefits. It explains when S-Corp status creates meaningful savings—and when it doesn’t. Approaching this strategically avoids fixing one problem while creating another.

What a Proper Late S-Corp Election Actually Does

When filed correctly and approved, a late S-Corp election can:

- Preserve tax savings for prior years

- Align your tax treatment with how your business actually operated

- Reduce future self-employment tax exposure

- Eliminate uncertainty around IRS compliance

Just as importantly, it gives clarity. You know where you stand, what applies retroactively, and

how to move forward cleanly. That certainty has value especially for growing businesses.

Conclusion : You Still Have Options

Missing the S-Corp deadline feels final, but it usually isn’t. The IRS provides a second chance through late S-Corp election relief, and many businesses qualify without realizing it. The opportunity, however, is time-sensitive and detail-driven. Accuracy matters. Intent matters.

Documentation matters.Handled correctly, a late election can protect years of tax savings and put your business back on the right footing. Handled casually, it can permanently close the door on those benefits.

If you’re unsure whether you qualify or want to avoid the risk of doing this wrong the safest next step is to speak with a professional who handles late S-Corp elections regularly.

Talk to a Tax Professional and Protect Your Retroactive S-Corp Status.

Clarity now can save tens of thousands later.