📋 Key Takeaways :

- Amended returns take up to 20 weeks to process

- Many business owners miss $10,000+ in deductions from past years

- We offer free 3-year return reviews to find overlooked money

- The IRS pays interest on delayed refunds

Ready to find money you may have left on the table? Get your filings reviewed and uncover opportunities the IRS may still owe you.

Where’s My Amended Return? And How It Could Be the Key to Paying for Your Tax Planning Services

Every month, thousands of people search Google asking: “Where’s my amended return?” It’s one of the most common tax questions out there — and for good reason. Filing an amended return can feel like waiting on hold with the IRS… except you don’t even get elevator music.

So let’s get to the part everyone wants to know first:

How long does it take to get an amended return processed?

The IRS says it takes up to 20 weeks (yes, weeks) to process an amended return, depending on the year of the original return and whether you filed it on paper or electronically. Older returns usually take longer. As of now, you can track your amended return using the IRS’s “Where’s My Amended Return?” tool, or by calling their hotline — though getting through isn’t always a smooth ride.

But, let’s take a step back…

Why are people amending their tax returns in the first place?

Here’s the reality most business owners don’t know: many tax professionals miss deductions or misapply credits, especially when they don’t specialize in proactive tax planning. That’s why at Simplify My Numbers, we offer a free or low-cost review of the last three years of your tax returns — because those are the only years still eligible for amendment under IRS rules.

What’s wild is that in most of those reviews, we find something. Something that was overlooked, misunderstood, or not applied strategically. And when that happens? The fix can mean money back in your pocket — even for taxes you already paid.

Yes! If it takes the IRS longer than 45 days after the due date of the original return (or the date you filed it, if later) to issue your refund, they will pay interest — just like you’d pay them interest if the roles were reversed. So not only could you get a refund, you could get a little extra on top.

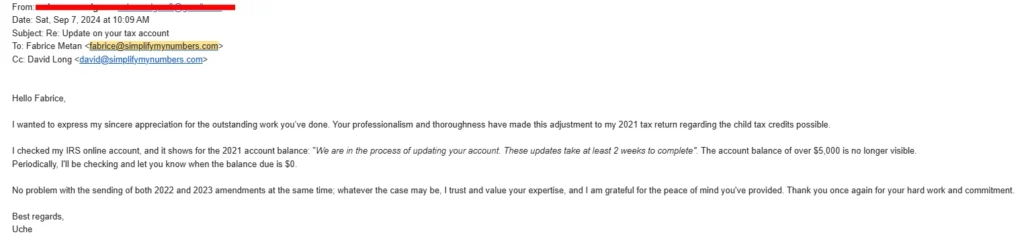

Real Story: How One Client Got a $10,000 Refund… Before We Even Started Their Tax Plan

A new client came to us frustrated with their previous CPA. We didn’t jump straight into creating a new tax plan. Instead, we asked to see their last three years of tax returns first.

Good thing we did.

After combing through the filings, we found multiple missed items that, once corrected, meant the client was eligible for $10,000 in refunds across two amended returns. That money was recovered before we even touched the current year’s taxes. In fact, that $10,000 more than covered what they paid us for our annual tax planning services.

In other words, it was like getting proactive tax planning for free.

"Where is my amended return?" you ask

If you’ve been working with a tax preparer who’s just been plugging in numbers — not proactively looking for savings — there’s a chance you’ve left money on the table.

At Simplify My Numbers, we don’t just help you look forward. We help you look back — because what we find back there could pay for everything ahead.

✅ Ready to find out what’s hiding in your past tax returns?

Fill out the questionnaire at the bottom of our Tax Planning Services page so we can review your filings and uncover opportunities the IRS may still owe you for.